Is There Property Tax In West Virginia . here are the typical tax rates for a home in west virginia, based on the typical home value of $169,446. The second installment is due march 1 of the next. this application allows for searching and displaying property ownership and location information for all 55 counties in west. how property taxes work in west virginia. understanding the west virginia property tax levy system and how the state determines assessed value can help you plan for your property taxes. The first due by sept. You can pay property taxes in west virginia in two annual installments: ad valorem property tax. All real and tangible personal property, with limited exceptions, is subject to property tax. the first installment is due september 1 of the property tax year. this wv property assessment portal is designed for searching and displaying property ownership and location.

from omaha.com

The first due by sept. All real and tangible personal property, with limited exceptions, is subject to property tax. The second installment is due march 1 of the next. ad valorem property tax. understanding the west virginia property tax levy system and how the state determines assessed value can help you plan for your property taxes. here are the typical tax rates for a home in west virginia, based on the typical home value of $169,446. the first installment is due september 1 of the property tax year. this application allows for searching and displaying property ownership and location information for all 55 counties in west. how property taxes work in west virginia. this wv property assessment portal is designed for searching and displaying property ownership and location.

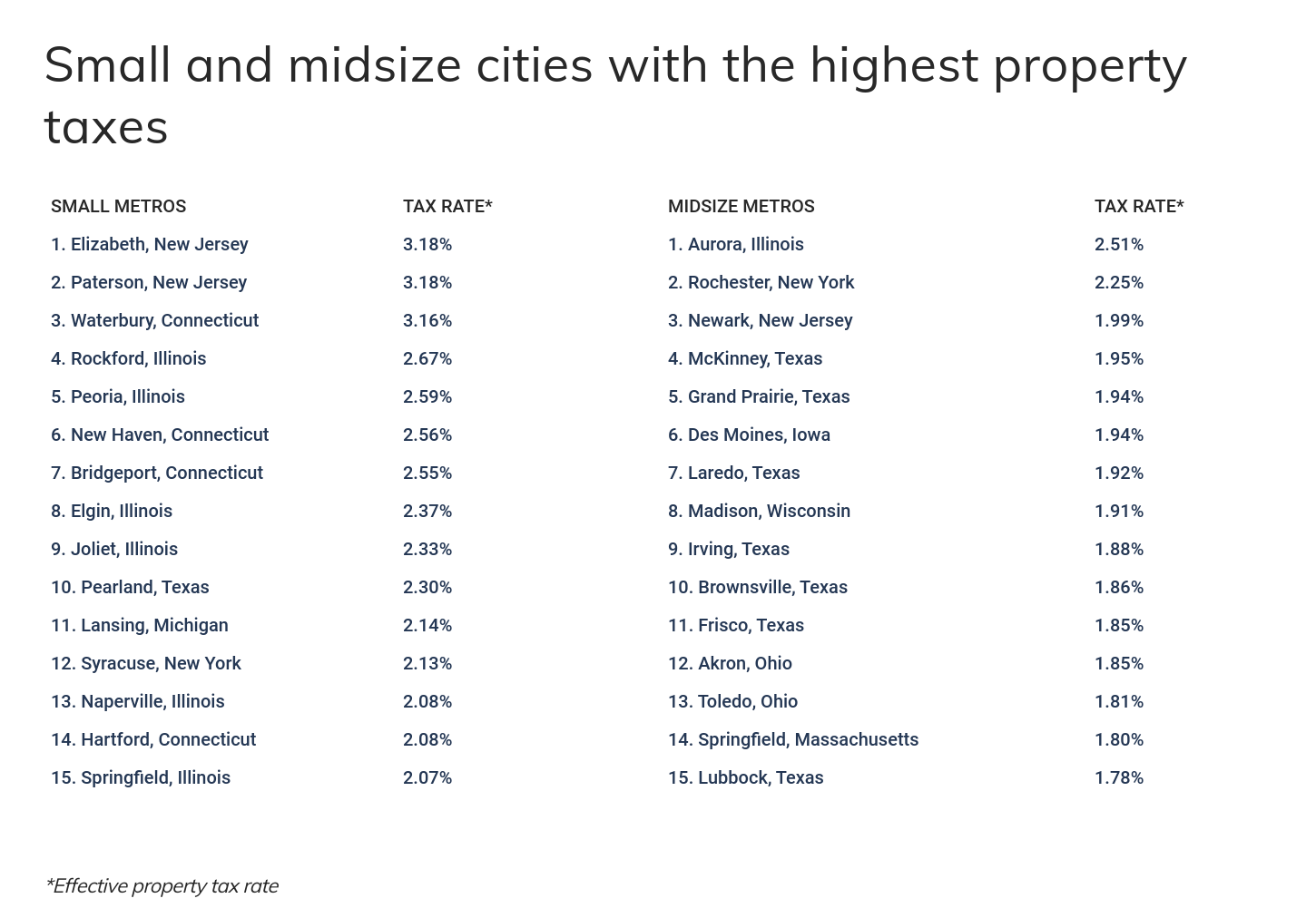

The cities with the highest (and lowest) property taxes

Is There Property Tax In West Virginia the first installment is due september 1 of the property tax year. this wv property assessment portal is designed for searching and displaying property ownership and location. ad valorem property tax. You can pay property taxes in west virginia in two annual installments: understanding the west virginia property tax levy system and how the state determines assessed value can help you plan for your property taxes. the first installment is due september 1 of the property tax year. All real and tangible personal property, with limited exceptions, is subject to property tax. this application allows for searching and displaying property ownership and location information for all 55 counties in west. how property taxes work in west virginia. The first due by sept. The second installment is due march 1 of the next. here are the typical tax rates for a home in west virginia, based on the typical home value of $169,446.

From www.pinterest.com

Chart 4 West Virginia Local Tax Burden by County FY 2015.JPG West Is There Property Tax In West Virginia how property taxes work in west virginia. this application allows for searching and displaying property ownership and location information for all 55 counties in west. the first installment is due september 1 of the property tax year. The second installment is due march 1 of the next. All real and tangible personal property, with limited exceptions, is. Is There Property Tax In West Virginia.

From wvpolicy.org

Data Doesn't Support Eliminating the Business Machinery, Equipment, and Is There Property Tax In West Virginia ad valorem property tax. here are the typical tax rates for a home in west virginia, based on the typical home value of $169,446. this application allows for searching and displaying property ownership and location information for all 55 counties in west. All real and tangible personal property, with limited exceptions, is subject to property tax. You. Is There Property Tax In West Virginia.

From taxfoundation.org

Business Tangible Personal Property Taxes Tax Foundation Is There Property Tax In West Virginia this application allows for searching and displaying property ownership and location information for all 55 counties in west. how property taxes work in west virginia. ad valorem property tax. this wv property assessment portal is designed for searching and displaying property ownership and location. All real and tangible personal property, with limited exceptions, is subject to. Is There Property Tax In West Virginia.

From www.financial-planning.com

20 states with the lowest realestate property taxes Financial Planning Is There Property Tax In West Virginia The first due by sept. All real and tangible personal property, with limited exceptions, is subject to property tax. the first installment is due september 1 of the property tax year. The second installment is due march 1 of the next. this wv property assessment portal is designed for searching and displaying property ownership and location. how. Is There Property Tax In West Virginia.

From sketchwhich.blogspot.com

greenbrier wv tax map Malena Strunk Is There Property Tax In West Virginia this wv property assessment portal is designed for searching and displaying property ownership and location. the first installment is due september 1 of the property tax year. this application allows for searching and displaying property ownership and location information for all 55 counties in west. understanding the west virginia property tax levy system and how the. Is There Property Tax In West Virginia.

From itep.org

North Carolina Who Pays? 6th Edition ITEP Is There Property Tax In West Virginia The first due by sept. understanding the west virginia property tax levy system and how the state determines assessed value can help you plan for your property taxes. here are the typical tax rates for a home in west virginia, based on the typical home value of $169,446. the first installment is due september 1 of the. Is There Property Tax In West Virginia.

From www.taxaudit.com

West Virginia Tax Return Change Sample 1 Is There Property Tax In West Virginia ad valorem property tax. The second installment is due march 1 of the next. understanding the west virginia property tax levy system and how the state determines assessed value can help you plan for your property taxes. how property taxes work in west virginia. You can pay property taxes in west virginia in two annual installments: Web. Is There Property Tax In West Virginia.

From taxedright.com

West Virginia State Taxes Taxed Right Is There Property Tax In West Virginia You can pay property taxes in west virginia in two annual installments: ad valorem property tax. how property taxes work in west virginia. The first due by sept. All real and tangible personal property, with limited exceptions, is subject to property tax. the first installment is due september 1 of the property tax year. here are. Is There Property Tax In West Virginia.

From business.wvu.edu

Chapter V West Virginia’s Counties John Chambers College of Business Is There Property Tax In West Virginia this wv property assessment portal is designed for searching and displaying property ownership and location. All real and tangible personal property, with limited exceptions, is subject to property tax. ad valorem property tax. The second installment is due march 1 of the next. how property taxes work in west virginia. understanding the west virginia property tax. Is There Property Tax In West Virginia.

From www.ezhomesearch.com

Your Guide to West Virginia Property Taxes Is There Property Tax In West Virginia ad valorem property tax. how property taxes work in west virginia. You can pay property taxes in west virginia in two annual installments: this wv property assessment portal is designed for searching and displaying property ownership and location. The second installment is due march 1 of the next. this application allows for searching and displaying property. Is There Property Tax In West Virginia.

From www.signnow.com

WV State Tax Department Fiduciary Estate Tax Return Forms Fill Out Is There Property Tax In West Virginia the first installment is due september 1 of the property tax year. ad valorem property tax. this wv property assessment portal is designed for searching and displaying property ownership and location. The second installment is due march 1 of the next. understanding the west virginia property tax levy system and how the state determines assessed value. Is There Property Tax In West Virginia.

From www.rwhamptonroads.com

What You Need To Know About Property Taxes in Virginia Is There Property Tax In West Virginia The first due by sept. ad valorem property tax. All real and tangible personal property, with limited exceptions, is subject to property tax. The second installment is due march 1 of the next. how property taxes work in west virginia. this wv property assessment portal is designed for searching and displaying property ownership and location. You can. Is There Property Tax In West Virginia.

From www.nationalmortgagenews.com

20 states with the lowest property taxes National Mortgage News Is There Property Tax In West Virginia You can pay property taxes in west virginia in two annual installments: All real and tangible personal property, with limited exceptions, is subject to property tax. understanding the west virginia property tax levy system and how the state determines assessed value can help you plan for your property taxes. here are the typical tax rates for a home. Is There Property Tax In West Virginia.

From diaocthongthai.com

Map of Logan County, West Virginia Is There Property Tax In West Virginia here are the typical tax rates for a home in west virginia, based on the typical home value of $169,446. understanding the west virginia property tax levy system and how the state determines assessed value can help you plan for your property taxes. All real and tangible personal property, with limited exceptions, is subject to property tax. Web. Is There Property Tax In West Virginia.

From sftreasurer.org

Understanding Property Tax Treasurer & Tax Collector Is There Property Tax In West Virginia ad valorem property tax. You can pay property taxes in west virginia in two annual installments: All real and tangible personal property, with limited exceptions, is subject to property tax. this wv property assessment portal is designed for searching and displaying property ownership and location. here are the typical tax rates for a home in west virginia,. Is There Property Tax In West Virginia.

From www.retirementliving.com

West Virginia Tax Rates 2024 Retirement Living Is There Property Tax In West Virginia All real and tangible personal property, with limited exceptions, is subject to property tax. here are the typical tax rates for a home in west virginia, based on the typical home value of $169,446. this wv property assessment portal is designed for searching and displaying property ownership and location. ad valorem property tax. understanding the west. Is There Property Tax In West Virginia.

From www.signnow.com

Fill in it 140 for Tax 20202024 Form Fill Out and Sign Printable PDF Is There Property Tax In West Virginia here are the typical tax rates for a home in west virginia, based on the typical home value of $169,446. how property taxes work in west virginia. ad valorem property tax. this application allows for searching and displaying property ownership and location information for all 55 counties in west. All real and tangible personal property, with. Is There Property Tax In West Virginia.

From www.zrivo.com

West Virginia Property Taxes 2023 2024 Is There Property Tax In West Virginia the first installment is due september 1 of the property tax year. ad valorem property tax. here are the typical tax rates for a home in west virginia, based on the typical home value of $169,446. All real and tangible personal property, with limited exceptions, is subject to property tax. understanding the west virginia property tax. Is There Property Tax In West Virginia.